Tax Planning for Physicians: Sample Plan Walk-Through

By Jared Andreoli, CFP®, CSLP®

As a physician, your time is limited—and your tax return probably isn’t your favorite weekend reading. But buried in that dense document are powerful planning opportunities that could save you thousands. At Simplicity Financial, we specialize in helping Milwaukee-area doctors like you understand how taxes intersect with your income, investments, and long-term goals.

Each year, I prepare a custom tax summary for my clients that transforms confusing forms into a clear, strategic plan. Below, I’ll walk you through a sample tax plan tailored for physicians, so you can see how this process works and why it matters.

How I Use Tax Planning Tools to Help Clients Gain Clarity

I use tax planning software to pull key data from your return and highlight the parts that matter most. It’s not something I expect clients to navigate on their own. I review the report with you, explain what I’m seeing, and point out areas worth discussing further.

This helps turn a dense tax document into a conversation starter. Whether we’re looking at your effective tax rate, deductions, or how investment income is taxed, it gives us a clearer picture to work from.

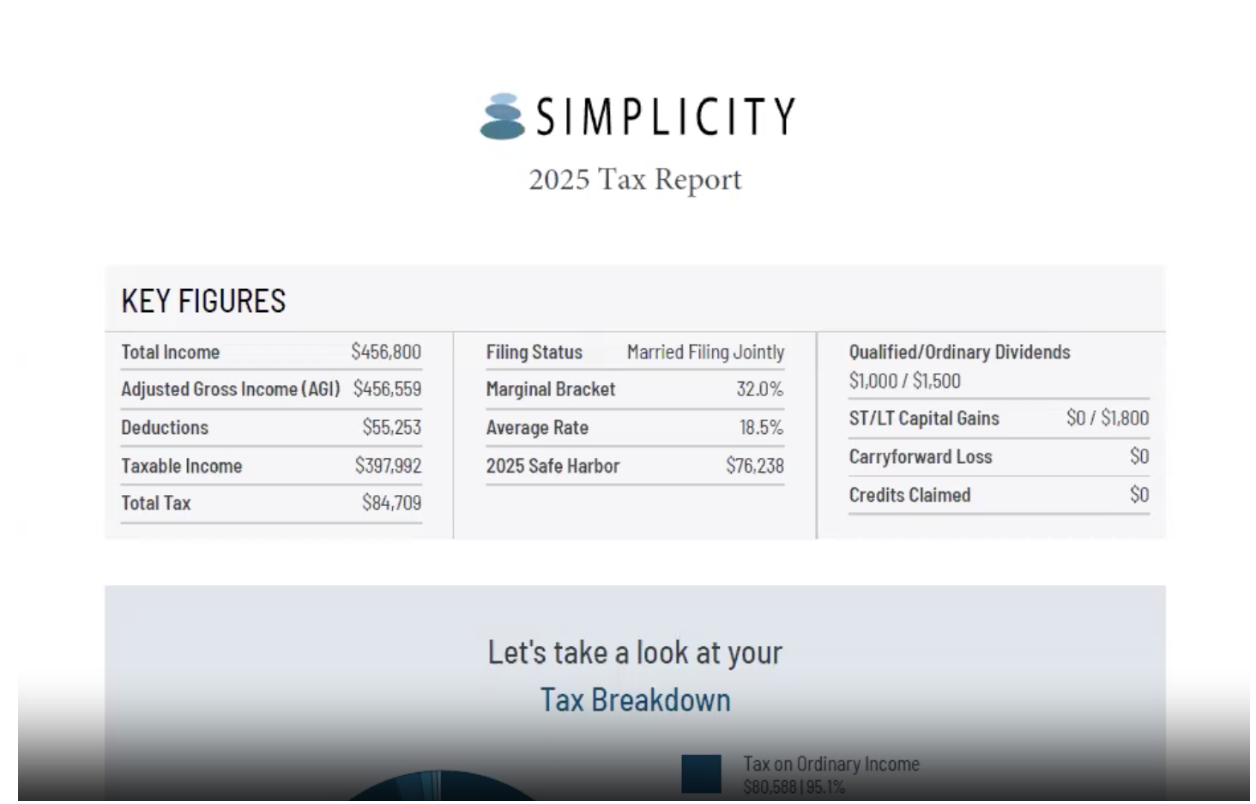

To show you what this process looks like in practice, I’ve created a sample tax plan for a fictional married couple. The first page provides a high-level summary of their return (income, deductions, tax brackets, and more) before we walk through each section in more detail.

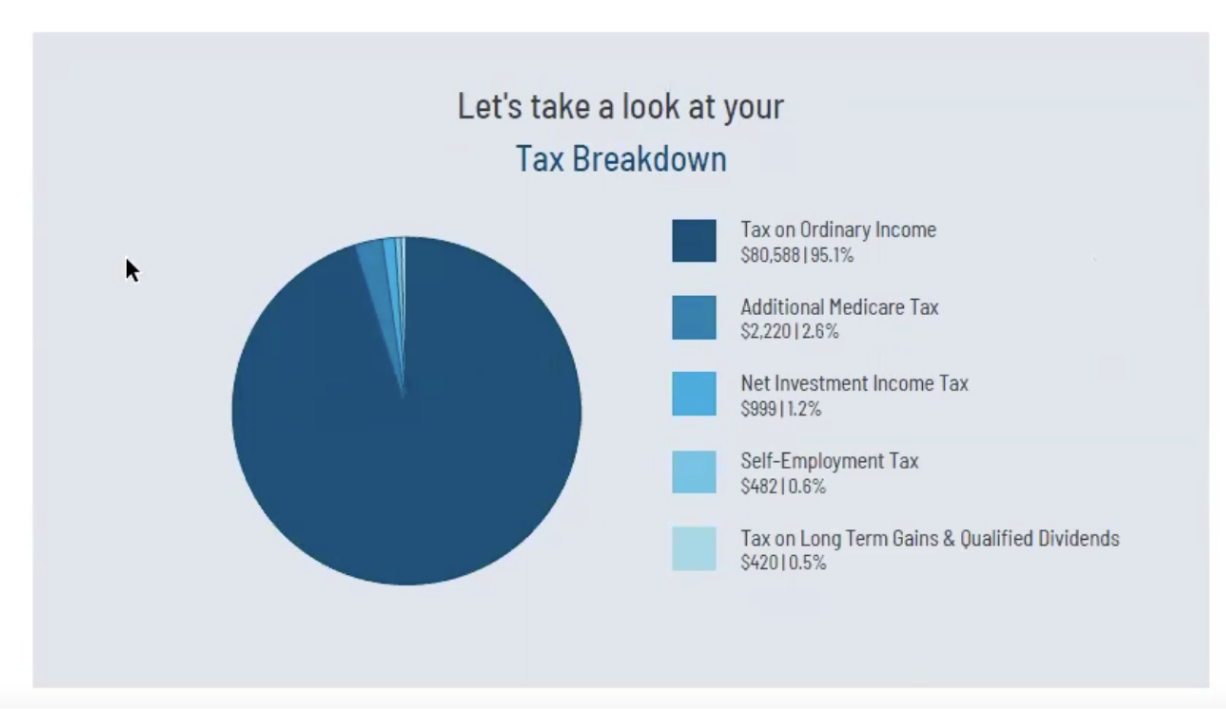

Your Tax Overview

This page of the sample plan gives a clear visual of where your total tax bill is coming from. In this case, the majority (over 95%) comes from ordinary income tax. The rest is made up of smaller components, like the Additional Medicare Tax, Net Investment Income Tax, and taxes on long-term gains or dividends.

Seeing it broken down this way helps you understand not just how much you’re paying, but what kind of income is being taxed and where there may be planning opportunities in the future.

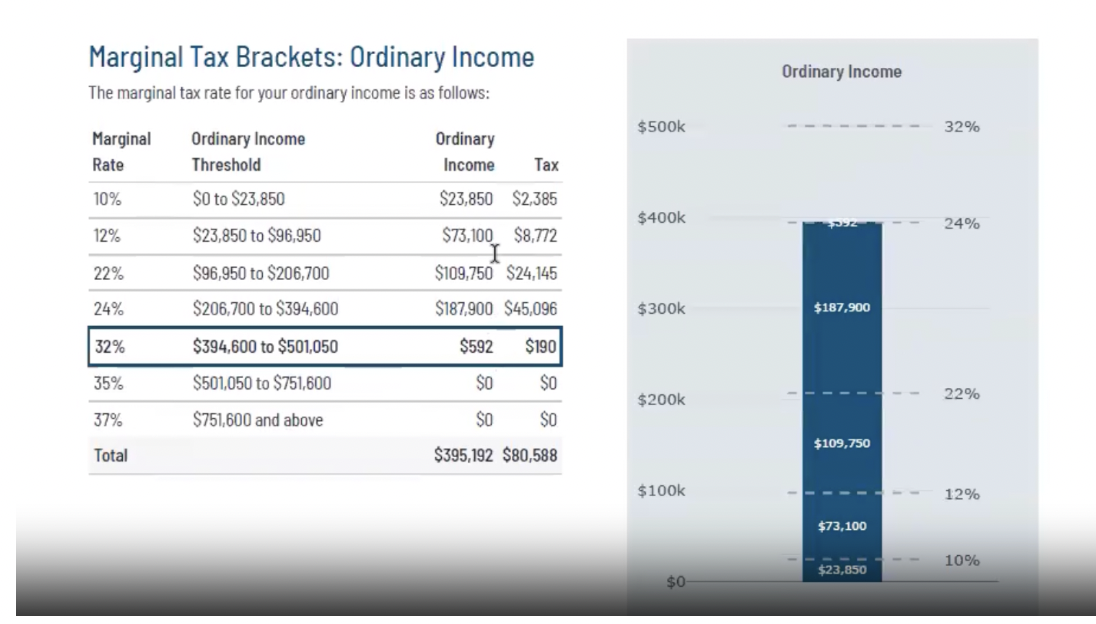

Reviewing Your Marginal Tax Brackets

Knowing your marginal tax bracket helps you see where each additional dollar of income is taxed. In this sample plan, the couple falls into the 32% marginal bracket, but only a small portion of their income is actually taxed at that rate.

Most of their income is taxed in the lower brackets, which is why their effective tax rate (what they actually paid across all income) is much lower at just 18.5%.

This breakdown shows how the tax system works in layers. It’s one of the first things I review with clients when we’re looking for ways to improve tax efficiency.

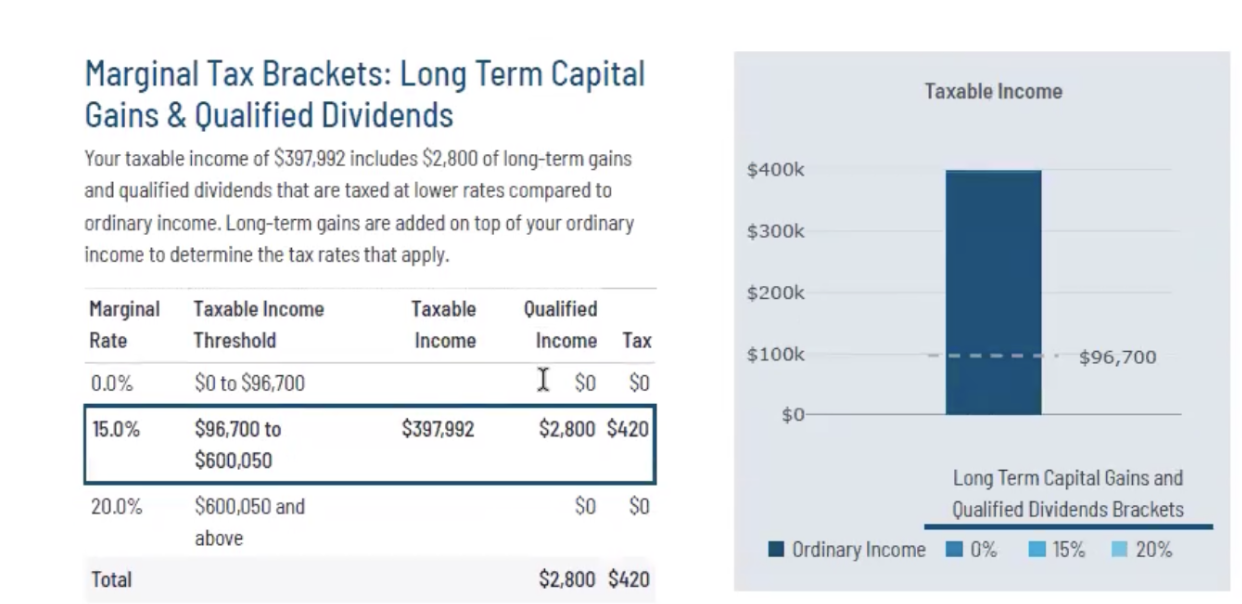

Capital Gains and Qualified Dividends

This part of the report shows how investment income is taxed—specifically long-term capital gains and qualified dividends, which are taxed at lower rates than ordinary income.

In this sample case, the couple had $2,800 in qualified investment income. Because their total income falls into the 15% capital gains bracket, that investment income is taxed at that rate, resulting in $420 of tax.

It’s a small piece of the overall picture, but it highlights why your total income level matters, even when your investment gains seem modest. When I review this with clients, we often use it as a jumping-off point to talk about how to manage capital gains in future years, especially when income might be higher or lower than usual.

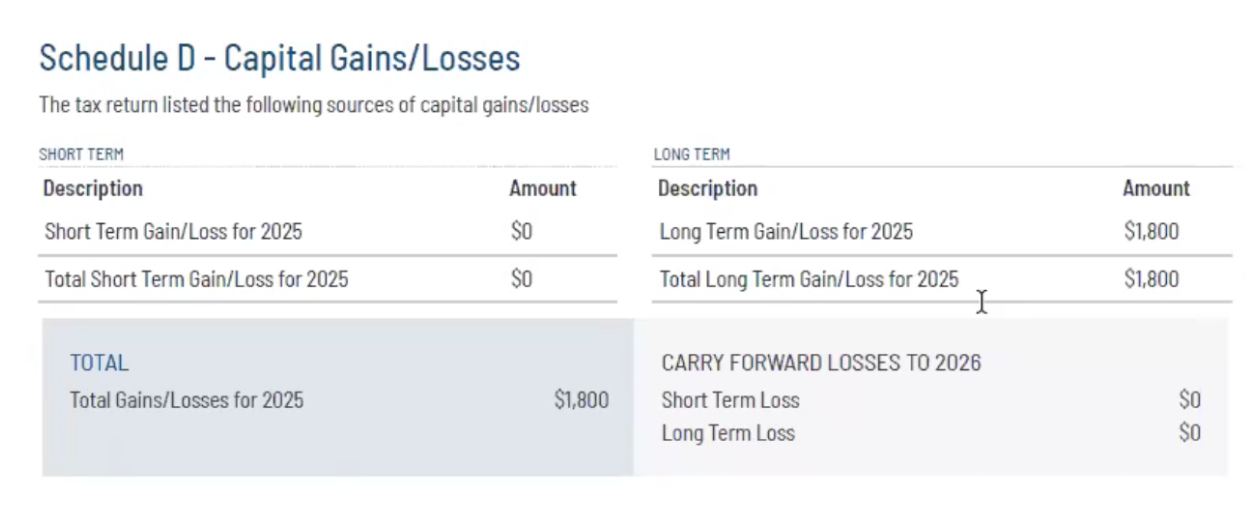

Here’s a closer look at how capital gains are reported (Schedule D).

In this sample, the couple had $1,800 in long-term capital gains for 2025. There were no short-term gains or losses, and nothing carried forward to next year.

When reviewing this with clients, I use it as an opportunity to talk through the timing of gains and losses, especially if you’re selling investments, harvesting losses, or expecting a big income shift in the coming year.

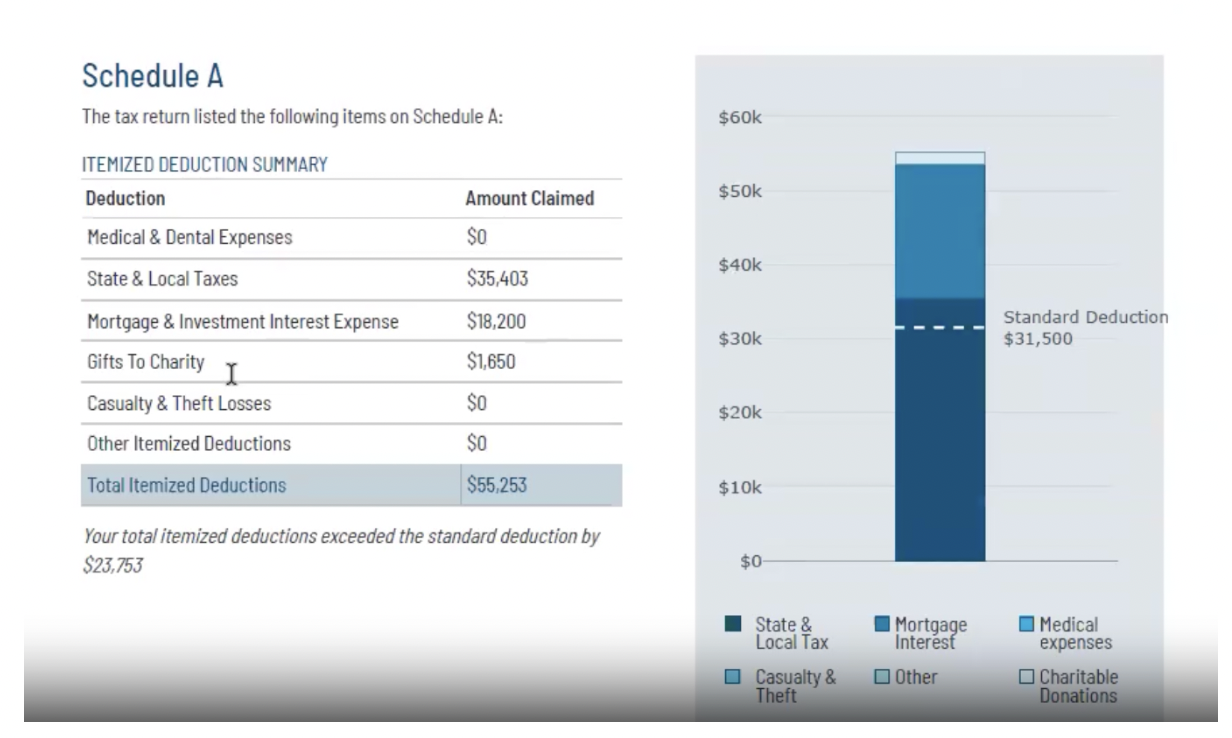

Breaking Down Your Itemized Deductions (Schedule A)

This page shows what the household was able to deduct by itemizing, rather than taking the standard deduction.

In this case, their itemized deductions totaled $55,253, which exceeded the 2025 standard deduction for a married couple ($31,500) by over $23,000. Most of their deductions came from state and local taxes and mortgage interest, with a smaller portion from charitable gifts.

I walk through this with clients each year to identify which deductions are making the biggest impact and whether it makes sense to itemize again, bunch donations, or explore other strategies for future years.

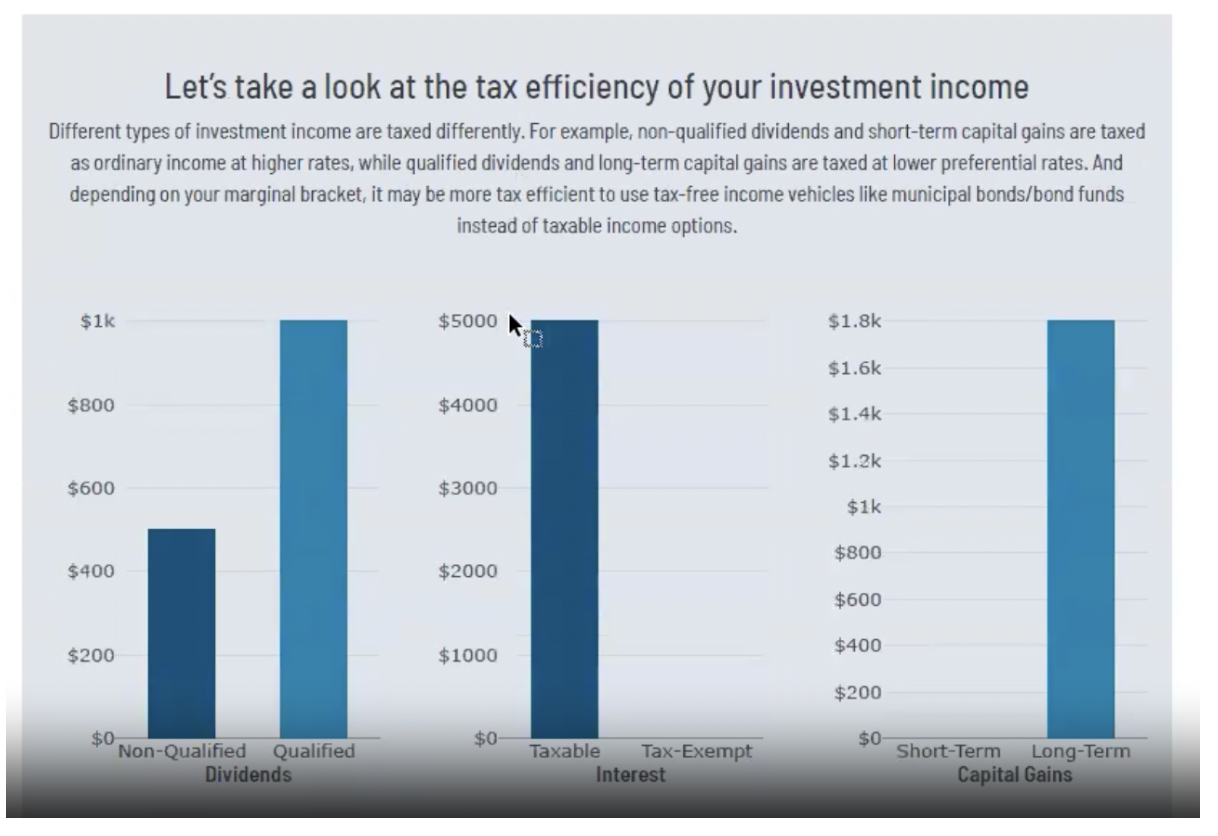

How Tax-Efficient Are Your Investments?

Not all investment income is taxed the same way. This part of the plan shows the difference between how qualified dividends, interest, and capital gains are treated and how that impacts your overall tax bill.

In this example, the couple’s investment taxes were relatively low. But if we saw a spike in short-term gains or taxable interest, we’d look at ways to reduce the impact going forward; like shifting to more tax-efficient holdings or adjusting the timing of sales.

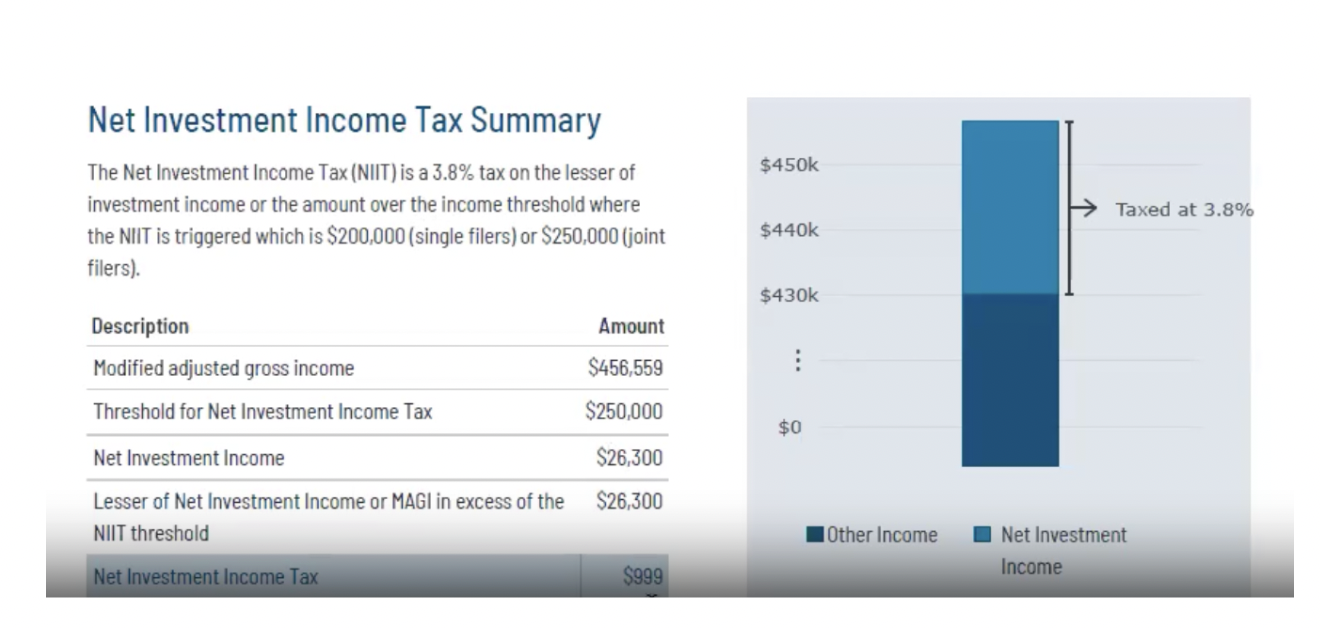

The second visual shows a lesser-known tax: the Net Investment Income Tax (NIIT). Because this household’s income exceeded the $250,000 threshold, a portion of their investment income was subject to an additional 3.8% tax. It’s something I monitor each year for clients, especially when income is expected to fluctuate.

Key Tax Planning Considerations

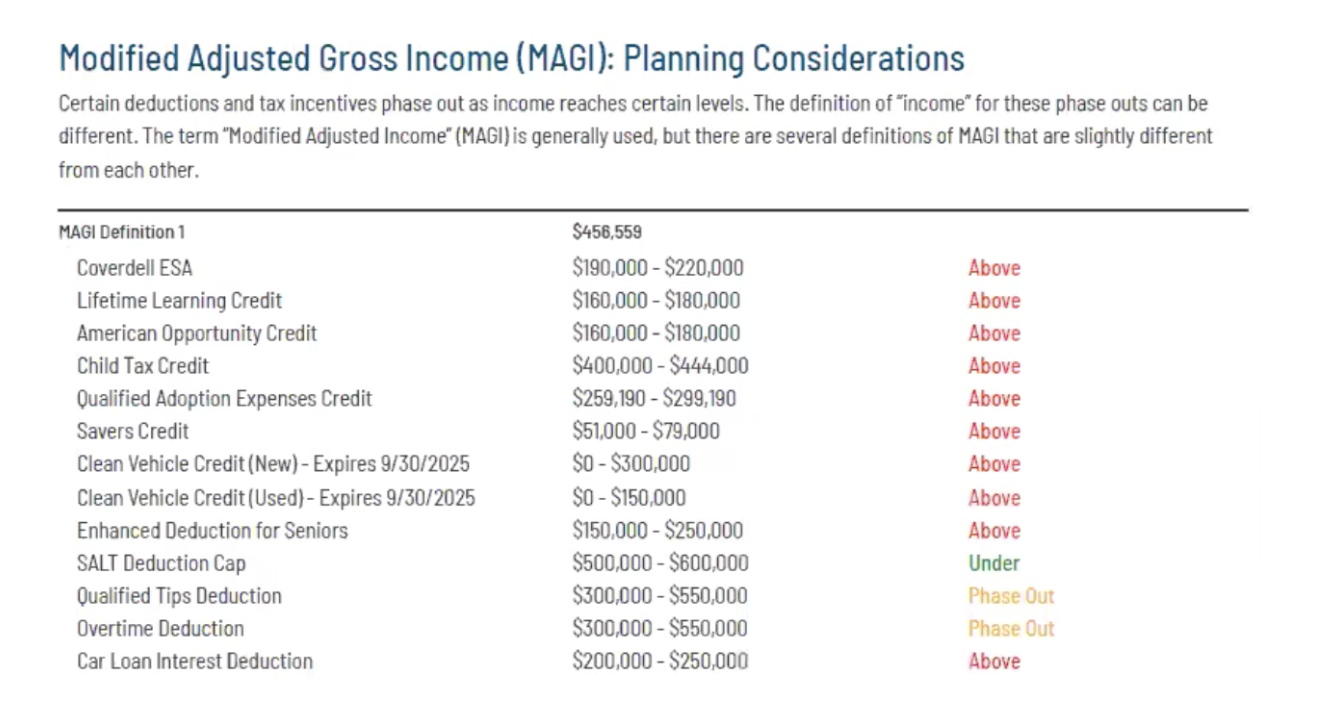

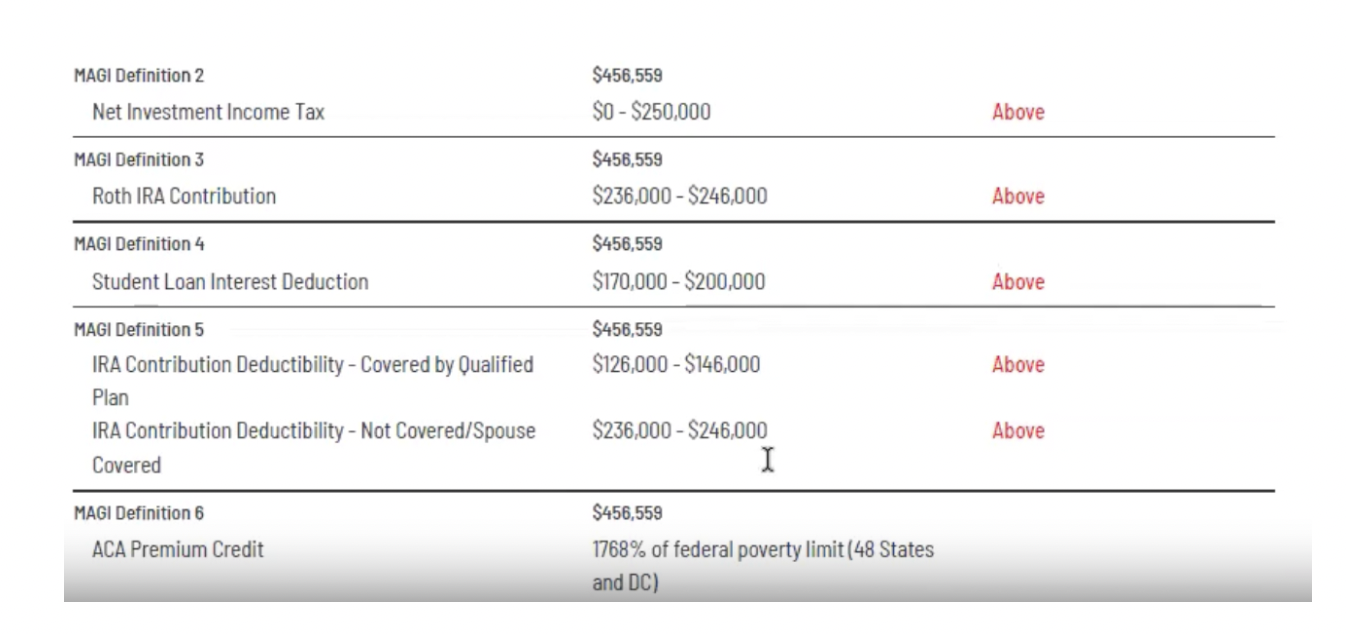

One part of the tax plan I always focus on with clients is how income affects eligibility for various deductions and credits. As your income goes up, some benefits start to phase out or disappear entirely.

In this case, the couple’s income is above the limits for things like the student loan interest deduction and Roth IRA contributions. The chart helps make that clear, showing where their income lands compared to each threshold.

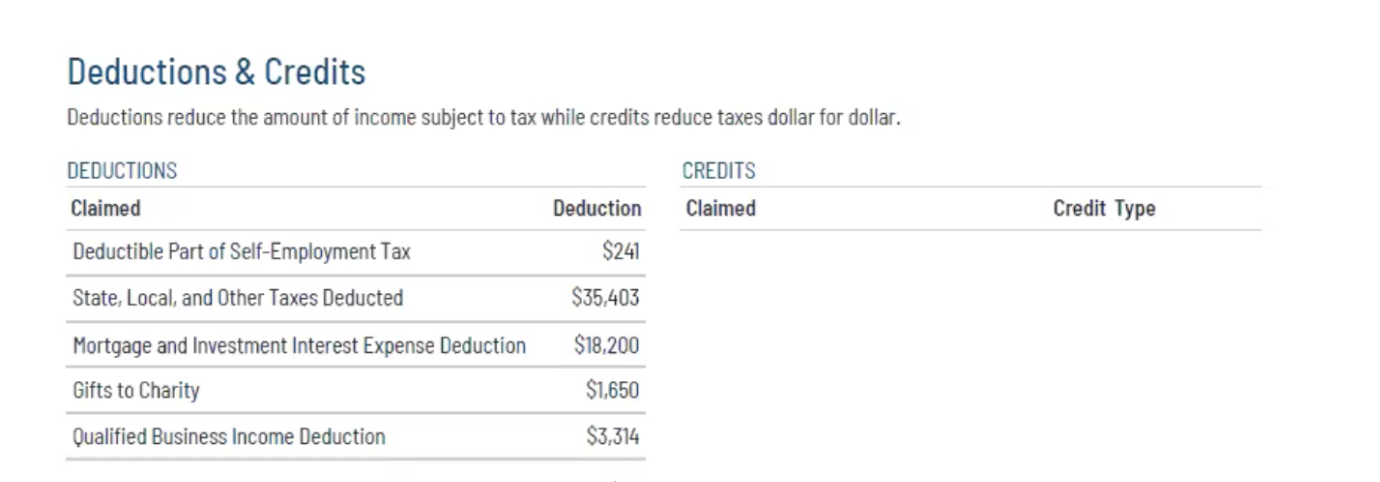

On the right, you see which deductions they were able to take. Most of these came from state and local taxes, mortgage interest, and a qualified business income deduction. There weren’t any tax credits claimed this year, but we keep an eye on those annually, especially if something in your life or income changes.

Here’s a quick snapshot of the deductions claimed in the return. These figures are already built into the broader tax plan, but I like to review them separately to spot trends and planning opportunities for future years.

Ready to Review Your Own Tax Picture?

At Simplicity Financial LLC, I create a tax summary like this for every client, every year, not just to review what happened but to plan ahead. If you’re a physician looking for a clearer understanding of how your taxes fit into your overall financial life, I’d be glad to help.

To get started, schedule a consultation or reach out directly at jared.andreoli@simplicityfinancialllc.com or 414-207-6473.

Tax Planning FAQs for Physicians in Milwaukee

Do physicians need a financial advisor for tax planning?

Many physicians benefit from working with a financial advisor, especially when income is high and time is limited. Tax planning is more than preparing to file; it involves making informed decisions throughout the year. At Simplicity Financial, I help Milwaukee-based doctors understand how their income, deductions, and investments affect their tax bill and overall financial plan.

What tax strategies can doctors use to lower their tax bill?

Some strategies include maximizing pre-tax retirement contributions, timing capital gains, tracking deductible expenses, and bunching charitable contributions. Depending on your situation, we might also explore Roth conversions or optimizing filing status. I walk through all this with clients as part of their annual tax review.

How much does a financial advisor charge for tax planning in Milwaukee?

At Simplicity Financial, tax planning is built into the overall financial planning relationship; there’s no separate fee for a one-time tax report. I work with early-career and mid-career physicians who want ongoing advice that goes beyond taxes, including investments, student loans, and long-term planning.

About Jared

Jared Andreoli, CFP®, CSLP®, is president and financial planner at Simplicity Financial, a fee-only RIA dedicated to helping early-career physicians conceptualize their financial picture and achieve their financial goals. Jared specializes in devising individualized financial road maps for clients, and he loves nothing more than a full day meeting with clients who value his partnership to solve problems—big and small.

After college, Jared spent six years working as a mutual fund administrator for a large company. While he learned an immense amount about the financial world, he was missing the personal connection of working with individual clients. Combining his passion for finance and personal connection, he established Simplicity Financial in 2017.

Jared has a degree in finance with a concentration in financial planning from Western Kentucky University, along with the CERTIFIED FINANCIAL PLANNER®, CFP® and a Certified Student Loan Planner (CSLP®) certifications. Outside of work Jared enjoys cooking and traveling. He played baseball in college and still coaches occasionally. He and his wife recently welcomed a daughter, who occupies most of their time. To learn more about Jared, connect with him on LinkedIn.