See a Sample Financial Plan for a Physician Who Just Left Residency

By Jared Andreoli, CFP®, CSLP®

As a physician, you have a lot to juggle as far as finances go. Between student loan repayment, lifestyle creep, and getting a late start on saving for retirement, financial planning can be overwhelming, to say the least. At Simplicity Financial, we believe every physician deserves a custom and comprehensive financial plan that helps them understand their current situation, address any weaknesses or threats, and take advantage of the financial opportunities available to help them pursue their goals. We understand that committing to a particular advisor or firm is a lot to ask without first seeing what the end product will look like. That’s why we’ve put together this sample financial plan to help you better understand what to expect when you choose to work with us.

What Does a Financial Plan Include?

First, you may be wondering about what goes into a comprehensive plan and how it is customized for a physician who just left residency. Financial plans often address a myriad of concerns and goals, from tax planning to retirement income strategizing. For a new physician straight out of residency, like our sample clients Michael and Jan Scott, we typically focus on boosting savings and paying down student loan debt.

Depending on your needs, your plan may narrow in on one element or address multiple goals you’d like to pursue over time. Whatever you choose to focus on, your financial plan is designed to serve as your road map, helping you pull all the moving parts of your finances together so you can make the most of your earning years and accumulate wealth in the most efficient way possible. Ultimately, our goal is help you retire to your ideal lifestyle—but it all starts with a plan.

See a Sample Financial Plan

Our sample financial plan, developed to reflect our planning process, looks at our sample clients, Michael and Jan Scott, outlines their current financial condition, including strengths and weaknesses, and identifies steps they can take to pursue their goals.

The Clients

Michael and Jan Scott are newlyweds who both work in the healthcare industry. Michael just finished his residency and is officially practicing as a physician. Jan is a pathologist at a local hospital. Though they have a combined $560,000 annual salary, they also have $511,000 in student loan debt and want to purchase a house in the next couple of years.

Net Worth & Cash Flow

The first step in building a financial plan is creating a net worth and cash flow statement. This helps us identify the strengths and weaknesses of Michael and Jan’s current financial situation. In doing this, we can find areas of improvement and ways to tweak their current habits to bring them in line with their goals.

As you can see, the Scotts have a current net worth of -$470,000 due to their large student loan balances. They have roughly $72,000 in assets, which is a good start but can certainly be improved based on their annual income. They have a monthly positive cash flow of $6,512, which means there is room to put more funds toward their goals.

Based on the net worth and cash flow statements, we can create a list of financial strengths and weaknesses as well as opportunities and threats. The Scotts are in a good position to improve their financial stability because of their high income, stable careers, and monthly cash surplus. They have low retirement savings relative to their income, poor tax efficiency, and an underdeveloped investment plan.

Investment Plan

First, we wanted to address the current investment allocation. As shown below, the Scotts were 76% in equities, which is a very conservative allocation and not typical for younger individuals in their 30s and 40s. They were also heavily weighted in the US.

We recommended they increase their equity exposure to 90% to take advantage of the growth in the market. Though this allocation poses a higher degree of risk, the Scotts are still decades away from retirement and will have more than enough time to ride out the short-term volatility of the market.

Increased Savings

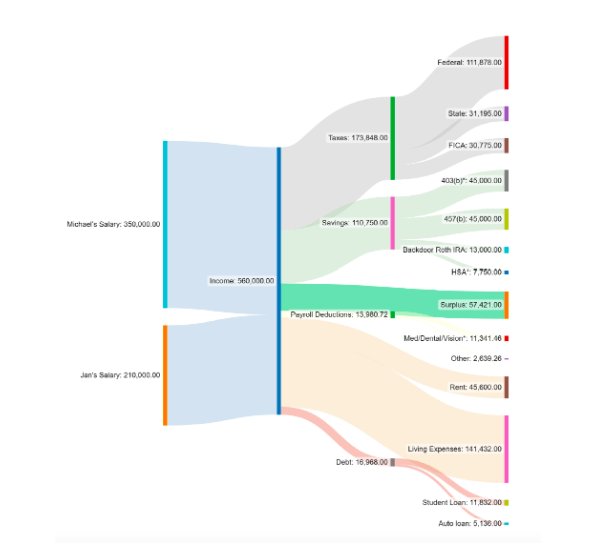

Next, we looked at how the Scotts could improve their overall savings. We like to see clients saving at least 20% of their income. The Scotts were only saving 6% prior to our plan. With our cash flow modifications below, we were able to increase their annual savings from $34,300 to over $110,000, and they still had a cash flow surplus of $57,000 at the end of the year.

Student Loan Repayment

Student loan repayment is a major consideration for physicians, and it was a top priority for the Scotts. We analyzed different repayment options to help them understand how Public Service Loan Forgiveness could impact their repayment. Jan was currently enrolled in the Pay As You Earn (PAYE) program, while Michael was enrolled in the Revised Pay As You Earn program. Based on our analysis, it made sense for Jan to continue her enrollment in PAYE and for Michael to switch to PAYE.

As shown below, utilizing the PAYE program and enrolling in the Public Service Loan Forgiveness program would help Michael and Jan qualify for a combined $366,000 in debt forgiveness.

Insurance Review

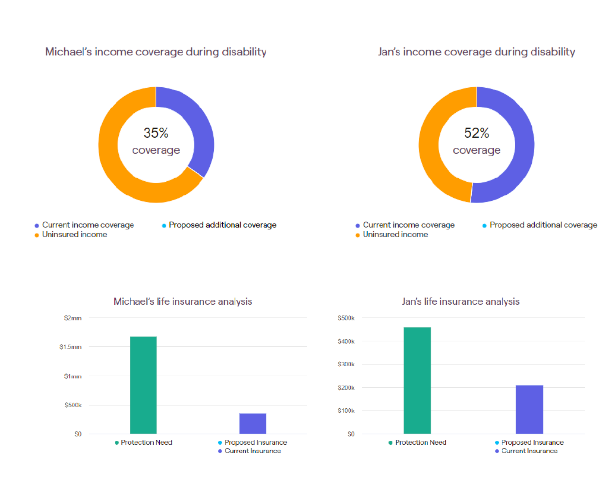

One of the biggest threats to earning power is the possibility of disability, yet many younger workers, like Michael and Jan, do not consider it when addressing their finances. We made sure to review their current insurance coverage and make both disability and life insurance recommendations to suit their needs.

Both Michael and Jan were underinsured when it came to disability and life insurance. They were enrolled in the standard policies offered by their employers, which left a significant gap in coverage. We recommended that they both obtain additional insurance through private policies, taking care to find “Own Occupation” and “Specialty Specific” policies for the disability protection.

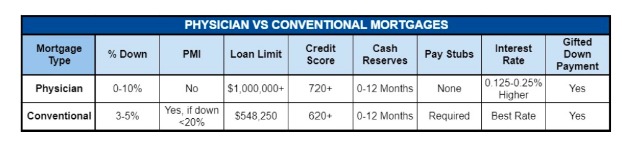

Housing Goals

Lastly, we analyzed the different mortgage options available for Michael and Jan as they plan for their first home purchase. We recommended the physician loan option as there are no PMI requirements. This would allow the Scotts to purchase a home with a smaller down payment, which would speed up the timeline for the purchase since they do not have significant liquid savings at this time.

Overall Results

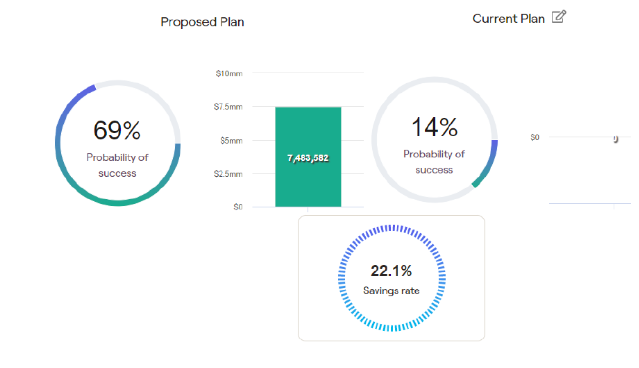

Putting it all together, we found that our proposed plan gave the Scotts a 69% probability of success versus a 14% chance with their current plan. We also helped boost their savings from 6% to 22% with just a handful of changes!

Keep in mind that this is only a hypothetical plan presented to illustrate what a client’s plan may resemble should they work with us. The characters and circumstances are completely fictional and are for illustrative purposes only. Be sure to seek the advice of a qualified professional for your particular situation and not rely upon any of the information herein to make personal financial decisions.

Experience the Simplicity Financial Difference

If you’re a physician looking for a customized financial plan that includes debt repayment, asset allocation, cash flow analysis, and more, we would love to hear from you! At Simplicity Financial, we specialize in working with physicians and our proven process can help you pursue your goals and get one step closer to financial freedom, all while having more time to do what you love.

Get started by scheduling a free consultation, or reach out to us by emailing jared.andreoli@simplicityfinancialllc.com or calling 414-207-6473.

About Jared

Jared Andreoli, CFP®, CSLP®, is president and financial planner at Simplicity Financial, a fee-only RIA dedicated to helping early-career physicians conceptualize their financial picture and achieve their financial goals. Jared specializes in devising individualized financial road maps for clients, and he loves nothing more than a full day meeting with clients who value his partnership to solve problems—big and small.

After college, Jared spent six years working as a mutual fund administrator for a large company. While he learned an immense amount about the financial world, he was missing the personal connection of working with individual clients. Combining his passion for finance and personal connection, he established Simplicity Financial in 2017.

Jared has a degree in finance with a concentration in financial planning from Western Kentucky University, along with the CERTIFIED FINANCIAL PLANNER™ (CFP®) and a Certified Student Loan Planner (CSLP®) certifications. Outside of work Jared enjoys cooking and traveling. He played baseball in college and still coaches occasionally. He and his wife recently welcomed a daughter, who occupies most of their time. To learn more about Jared, connect with him on LinkedIn.